What is Arbitrage in Forex Trading?

Using Arbitrage in Forex Trading has become a popular option for savvy investors looking to make a profit. But what exactly is Arbitrage in Forex Trading?

What is Forex Arbitrage?

Basically, forex arbitrage is a strategy used in the foreign exchange market, where traders buy or sell a currency pair at a higher or lower price than others. By doing so, they can earn profit from the difference in price. It is an efficient method of minimizing the inefficiencies of the market.

For example, if the EUR/USD rate on FXCM is at 1.11805, the EUR/USD on Oanda will be priced at 1.111810. The same applies to the USD/JPY. A high-frequency trading firm can exploit such small discrepancies and make profits from them.

For example, if the EUR/USD rate on FXCM is at 1.11805, the EUR/USD on Oanda will be priced at 1.111810. The same applies to the USD/JPY. A high-frequency trading firm can exploit such small discrepancies and make profits from them.

What is High Frequency Trading?

Using advanced technology, high frequency traders can buy and sell shares within milliseconds. This is a powerful tool that can help to lower trading costs and dampen volatility in the market.

High frequency trading uses complex mathematical models to identify and make trades at a rapid speed. These algorithms can be programmed to scan the markets looking for opportunities to make a profit.

Aside from speed, the other advantage of high-frequency trading is the ability to create a highly liquid market. This means that traders can meet more often, resulting in faster execution of orders.

This also reduces the bid-ask spread, making the market more efficient. However, some investors are wary of investing in HFT. They argue that small investors don’t have the resources to compete with HFT computers.

How Does HFT Utilize Arbitrage?

Traders interested in how does HFT utilize arbitrage in Forex trading should be aware of the many ways that this technique can be used. There are multiple types of strategies, but the main benefit of these methods is their speed.

An efficient HFT algorithm can detect trades as soon as they become available and place a large number of orders on several exchanges. This allows them to place hundreds of positions within minutes.

An efficient HFT algorithm can detect trades as soon as they become available and place a large number of orders on several exchanges. This allows them to place hundreds of positions within minutes.

Arbitrage can be profitable, but there are several risks involved. This includes execution risk, latency and trade-related latencies.

An arbitrageur will need to be able to scan markets quickly and react quickly to pick up opportunities. In the real world, this is usually a matter of a few seconds.

An efficient HFT algorithm will be able to determine the right price levels, and then make a purchase or sell order at the highest or lowest possible price. This will cause the price differential to shrink eventually. This means that an arbitrageur will have a profit if the difference between two prices is small enough.

What Are the Three Methods of Forex Arbitrage?

Traders look for arbitrage opportunities in the forex market to take advantage of price differentials. The goal of the strategy is to purchase a cheaper asset while selling an expensive asset.

There are many different ways to make money with forex arbitrage. The most common is interest rate arbitrage, which involves buying a foreign currency that has a higher interest rate and selling one that has a lower interest rate. This net difference in rates is the trading profit.

There are many different ways to make money with forex arbitrage. The most common is interest rate arbitrage, which involves buying a foreign currency that has a higher interest rate and selling one that has a lower interest rate. This net difference in rates is the trading profit.

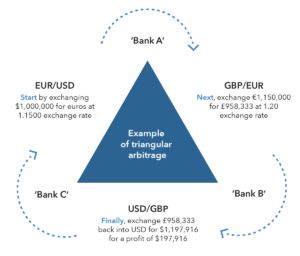

Another type of arbitrage is spot-future arbitrage. This involves taking positions in the same currency in both the spot and futures markets. Often, the trader buys the currency on the spot market and sells it on the futures market.

A third type of arbitrage is a cross-currency transaction, which is a pair of currencies that are not U.S. dollars. The Japanese Yen is often used as a currency in these transactions.

How Latency Affects HFT Arbitrage Profits

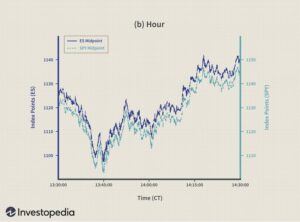

HFT strategy profitability depends on two factors: latency and competition (i.e. the number of robots taking advantage of the same alpha).

If you are lucky to be the only one who uses the alpha you do not have to care much about the latency. If there is at least one more robot on this alpha you only make money (or make more money) if you are faster. The more competitors you have the more important the latency factor.

Trading infrastructure considerably affects the trading results because it is there the latency provided.

The latency is made up of the following parameters:

a) Market data propagation time from the data source to the server running the trading platform and the strategy. Delay in the channels matters if the market data is sourced from other exchanges.

b) The time that elapses between data packet delivery to the network adapter and data delivery to the application. The network adapter takes time to process the package and then it takes time to deliver the package to the application.

c) Strategy execution time. It is the promptness of your trading system that is the key to competitive performance. Your server’s hardware and operating system ability to process in low-latency are important, as is the speed of your VPS.

d) Time for the order to get from the application to the Ethernet cable.

e) Time for the order to get from your server to the exchange.

Is HFT Forex Arbitrage Profitable?

Using Forex arbitrage, investors purchase or sell an asset at a lower price to benefit from the difference. This can take the form of a stock option or an interest rate differential. It is a strategy that can help traders to make money in volatile markets.

Using Forex arbitrage, investors purchase or sell an asset at a lower price to benefit from the difference. This can take the form of a stock option or an interest rate differential. It is a strategy that can help traders to make money in volatile markets.

Efficient market theory works in theory but does not necessarily translate into practice. Consequently, traders need to be aware of a number of risk factors, including execution and transaction costs, latency, commissions and slippage. The trader may also need to be careful about price quote errors.

To be able to compete at HFT level, you need direct access to the exchange. HFT is trading in milliseconds, so you need your computer army to be physically situated near the exchange servers.

The more cable that lies between you and the exchange server, the less are your chances to win. Light travels very fast, but the speed of light is finite.

For example, a trader with a computer situated in New York will win in HFT over the trader situated in London if they are trading at NYSE, all else equal. If they were to trade at LSE, they change places, and now the London-based trader wins.

Controversial?

HFT is controversial and has been met with some harsh criticism. Decisions happen in milliseconds, and this could result in big market moves without reason. As an example, on May 6, 2010, the Dow Jones Industrial Average (DJIA) suffered its largest intraday point drop ever, declining 1,000 points and dropping 10% in just 20 minutes before rising again. A government investigation blamed a massive order that triggered a sell-off for the crash.

Conclusion

This video explains arbitrage and HFT concepts well and it’s only about ten minutes long.

I hope that you found this to be of use. If you would like to subscribe and receive a notification each time I post, please use the subscribe form at the top of the left column. Feel free to rate, share and comment away! I just love to hear from readers.

My favourite prop firms:

- Funded Trading Plus (Use Coupon Code DAR10 for 10% off)

- E8 Funding (Use Coupon Code REB8 for 8% off)

- MFF

- FTMO

Feel like reading more? Let me suggest What is Spread in Forex?

Related Posts

Technical Analysis: 4 Stocks with signs of death crossovers to keep an eye on

HDFC Bank & 3 other fundamentally strong stocks trading above 200 DMA to keep an eye on

Falling Channel Breakout: Multibagger NBFC Stock Shows Bullish Momentum on Daily Chart

4 Fundamentally strong stocks to buy for an upside potential of up to 36%; Do you hold any?