How Brokers Manipulate the Forex Market

The foreign exchange market (Forex) is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. As a result, it attracts a wide range of market participants, including brokers who play an essential role in facilitating transactions. However, brokers can also manipulate Forex markets, which can harm traders and investors.

This article will explore how brokers can manipulate Forex markets and what traders can do to protect themselves.

The Various Ways to Manipulate the Forex Market

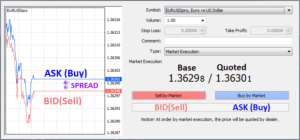

Slippage and Spreads

Firstly, it is important to understand that Forex brokers can manipulate markets in several ways. One of the most common forms of manipulation is known as slippage. Slippage occurs when a broker executes a trader’s order at a different price than the one requested. In most cases, this happens when market volatility is high, and liquidity is low. Brokers may also

Firstly, it is important to understand that Forex brokers can manipulate markets in several ways. One of the most common forms of manipulation is known as slippage. Slippage occurs when a broker executes a trader’s order at a different price than the one requested. In most cases, this happens when market volatility is high, and liquidity is low. Brokers may also  manipulate slippage by widening spreads, which can increase the cost of trading for traders.

manipulate slippage by widening spreads, which can increase the cost of trading for traders.

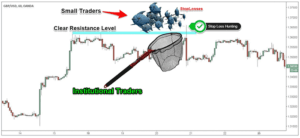

Stop-Loss Hunting

Another form of manipulation is stop-loss hunting. This occurs when brokers intentionally trigger a trader’s stop-loss order, causing the trader to exit a position prematurely. This can happen when brokers trade against their clients, taking the opposite side of the trade. By triggering stop-loss orders, brokers can generate additional profits and reduce their risk exposure.

False Information

Brokers can also manipulate markets by providing false information to their clients. For example, they may manipulate price feeds, misrepresent market conditions, or provide biased research and analysis. By doing so, brokers can encourage traders to take positions that are not in their best interest, leading to losses.

Brokers can also manipulate markets by providing false information to their clients. For example, they may manipulate price feeds, misrepresent market conditions, or provide biased research and analysis. By doing so, brokers can encourage traders to take positions that are not in their best interest, leading to losses.

Insider Trading

Finally, brokers can manipulate markets through insider trading. This occurs when brokers use their access to market data and order flow to make profitable trades before their clients. This can create a conflict of interest between brokers and their clients and erode trust in the financial system.

Finally, brokers can manipulate markets through insider trading. This occurs when brokers use their access to market data and order flow to make profitable trades before their clients. This can create a conflict of interest between brokers and their clients and erode trust in the financial system.

How to Protect Yourself from Forex Market Manipulation

So, how can traders protect themselves from broker manipulation in Forex markets? Firstly, traders should choose a reputable broker who is regulated by a respected authority. Regulated brokers are subject to strict rules and regulations, which can reduce the risk of manipulation. Secondly, traders should be aware of the risks associated with trading, including slippage and stop-loss hunting. They should also monitor their trades closely and use risk management tools such as stop-loss orders to limit their losses.

In conclusion, broker manipulation in Forex markets is a real risk for traders and investors. Brokers can manipulate markets in several ways, including slippage, stop-loss hunting, providing false information, and insider trading. Traders can protect themselves by choosing a reputable broker, being aware of the risks, and using risk management tools. By doing so, traders can increase their chances of success and reduce the risk of manipulation.