How do EAs Work in Ranging vs Trending Markets?

Expert Advisors (EAs) are automated trading systems that traders use to trade in the financial markets. EAs are popular because they can trade 24/7 without human intervention, have the ability to process vast amounts of data quickly, and remove emotions from trading decisions. One question that traders often ask is how EAs react in ranging vs trending markets.

What are ranging and trending markets?

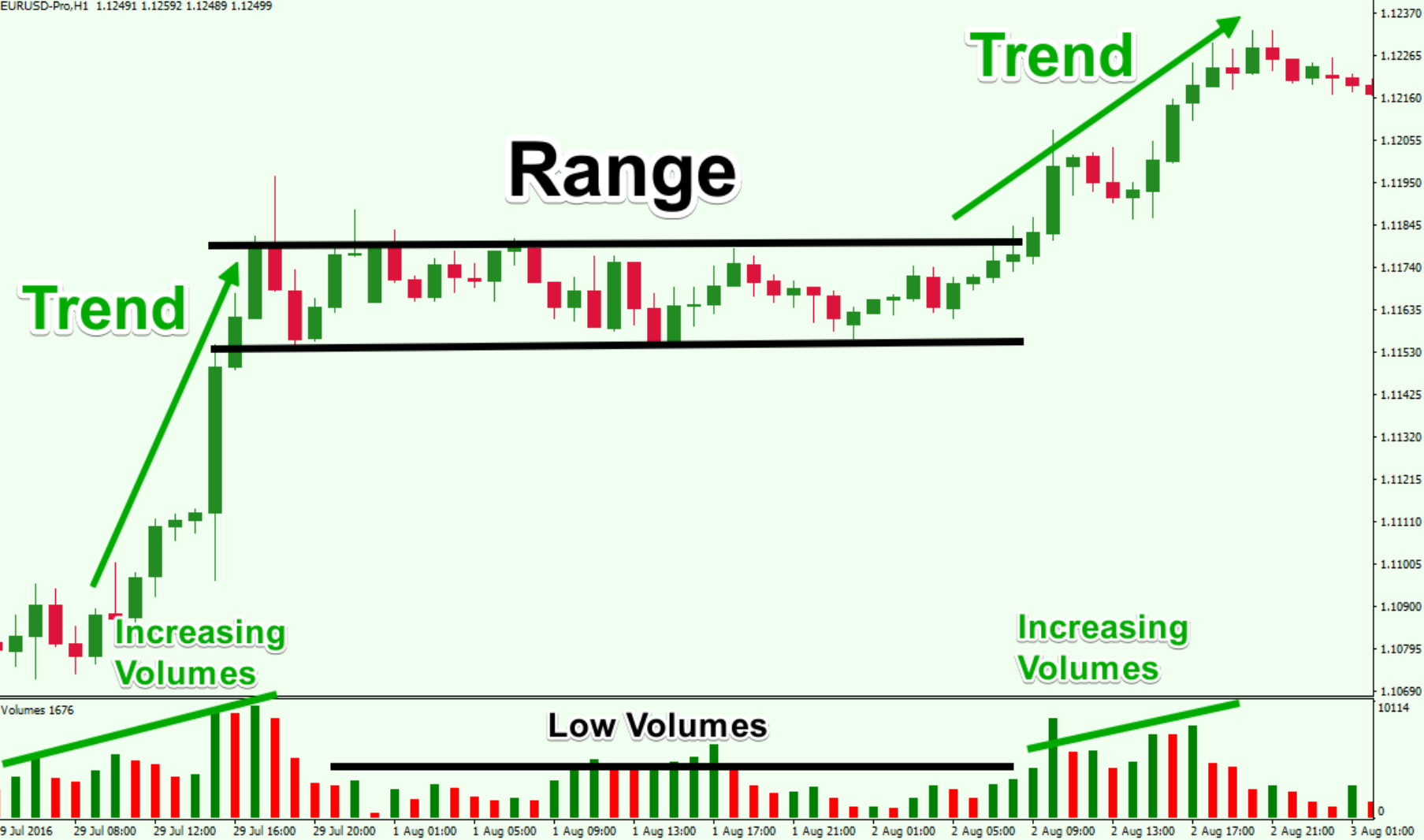

A ranging market is one in which the price moves mostly sideways within a range, without any clear direction. Ranging markets occur when the price is  neither making significant highs nor lows. Traders also refer to ranging markets as consolidating markets.

neither making significant highs nor lows. Traders also refer to ranging markets as consolidating markets.

Market consolidation refers to a period of time when prices move within a defined range or channel. Consolidation periods usually occur after a strong price movement, such as a trend, and can last for a short or extended period. Consolidation periods can provide traders with an opportunity to identify key support and resistance levels, which can be used to trade when the price breaks out of the consolidation period.

A trending market is one in which the price moves in a clear direction, either up or down. The price moves in higher highs and higher lows in an uptrend and lower lows and lower highs in a downtrend.

How do EAs react in ranging markets?

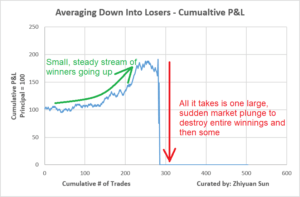

In a ranging market, EAs that rely on trend-following strategies may struggle to make profitable trades since there is no clear trend to follow. These EAs are designed to identify and follow trends, and in a ranging market, there are no clear trends to follow. Instead, EAs that use range-bound strategies, such as mean reversion or support and resistance levels, may perform better since they are designed to identify areas of price consolidation and attempt to buy low and sell high within those ranges.

In a ranging market, EAs that rely on trend-following strategies may struggle to make profitable trades since there is no clear trend to follow. These EAs are designed to identify and follow trends, and in a ranging market, there are no clear trends to follow. Instead, EAs that use range-bound strategies, such as mean reversion or support and resistance levels, may perform better since they are designed to identify areas of price consolidation and attempt to buy low and sell high within those ranges.

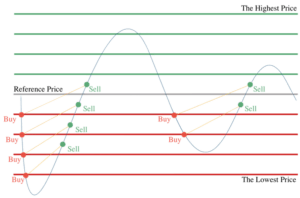

Range-bound EAs are designed to identify key levels of support and resistance, which are areas where the price has historically bounced off or been unable to break through. These EAs typically look for opportunities to buy near support levels and sell near resistance levels, attempting to capture profits as the price moves back towards the center of the range.

Range-bound EAs are designed to identify key levels of support and resistance, which are areas where the price has historically bounced off or been unable to break through. These EAs typically look for opportunities to buy near support levels and sell near resistance levels, attempting to capture profits as the price moves back towards the center of the range.

How do EAs react in trending markets?

In a trending market, trend-following EAs may perform better since they are designed to identify and follow trends. These EAs attempt to capture profits as the price moves in a clear direction. Range-bound EAs may struggle to make  profitable trades since they rely on price consolidation within a range and may miss out on potential profits from a trending market.

profitable trades since they rely on price consolidation within a range and may miss out on potential profits from a trending market.

Trend-following EAs are designed to identify trends using indicators such as moving averages or trend lines. These EAs typically look for opportunities to buy when the price is trending up and sell when the price is trending down, attempting to capture profits as the price moves in the direction of the trend.

How do market consolidation and ranging markets compare?

Market consolidation and ranging markets are similar in that they both refer to a period of time when prices move within a defined range or channel. However, consolidation periods usually occur after a strong price movement, such as a trend, while ranging markets can occur at any time.

During consolidation periods, prices may continue to move within the defined range or channel, and traders may look for opportunities to trade when the price breaks out of the consolidation period. Range-bound EAs can be useful in identifying these key support and resistance levels, which can be used to trade when the price breaks out of the consolidation period.

In a ranging market, the price is moving within a range without any clear direction. Traders can use range-bound EAs to identify key support and resistance levels and attempt to buy low and sell high within those ranges. However, in a ranging market, there is no clear trend to follow, which may make it challenging for trend-following EAs to make profitable trades.

Factors to consider when selecting an EA

When selecting an EA, traders should consider several factors, including the following:

Trading Style

Traders should select an EA that is compatible with their trading style. For example, traders who prefer range trading may prefer an EA that uses range-bound strategies, while traders who prefer trend trading may prefer an EA that uses trend-following strategies.

Market Conditions

Traders should select an EA that can adapt to changing market conditions. Some EAs may be able to adapt to ranging and trending markets, while others may struggle to perform when the market changes. Traders should also be aware of market news and events that could affect market conditions and adjust their EAs accordingly.

Backtesting and Forward Testing

Traders should backtest and forward test EAs to ensure they perform as intended. Backtesting involves testing an EA on historical data to see how it would have performed in the past. Forward testing involves testing an EA in a demo account to see how it performs in real-time market conditions.

Conclusion

In conclusion, EAs can react differently in ranging vs. trending markets. Range-bound EAs may perform better in ranging markets, while trend-following EAs may perform better in trending markets. Traders should carefully select EAs that are compatible with their trading style and adjust them as market conditions change to ensure they continue to perform as intended.

It’s also essential to note that traders should consider market consolidation periods when selecting an EA. While market consolidation periods and ranging markets share similarities, consolidation periods occur after a strong price movement, while ranging markets can occur at any time. Traders can use range-bound EAs to identify key support and resistance levels during consolidation periods, which can be used to trade when the price breaks out of the consolidation period.

My favourite prop firms:

- Funded Trading Plus (Use Coupon Code DAR10 for 10% off)

- E8 Funding (Use Coupon Code REB8 for 8% off)

- MFF

- FTMO

If you like this post and would like to be notified of new posts, subscribe in the top right of this page. Please rate, share and comment!

Check out another article of mine here: What is Backtesting and How is it Done?