Moving Average Demystified: How to Use It for Forex Trading

The moving average (MA) and exponential moving average (EMA) are popular Forex indicators used by traders to identify trends and potential entry and exit points for trades. In this blog post, we’ll take a closer look at these indicators and how to use them effectively in your trading strategy.

Moving Averages

A moving average is a technical indicator that calculates the average price of a currency pair over a certain time frame. The indicator smooths out price fluctuations and provides a visual representation of the currency pair’s price trend. There are three types of moving averages: Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA). In this post, we’ll focus on SMA and EMA.

Simple Moving Average (SMA)

The Simple Moving Average (SMA) is the most basic moving average indicator. It’s calculated by adding the closing prices of a currency pair over a selected time period and dividing the total by the number of periods. For example, if you select a 20-period SMA, the indicator will calculate the average closing price of the currency pair over the last 20 periods.

To use the SMA indicator, traders look for crossovers between the SMA line and the price of the currency pair. When the price of the currency pair crosses above the SMA line, it’s a bullish signal, and when the price crosses below the SMA line, it’s a bearish signal. Traders can use these signals to enter or exit trades.

Exponential Moving Average (EMA)

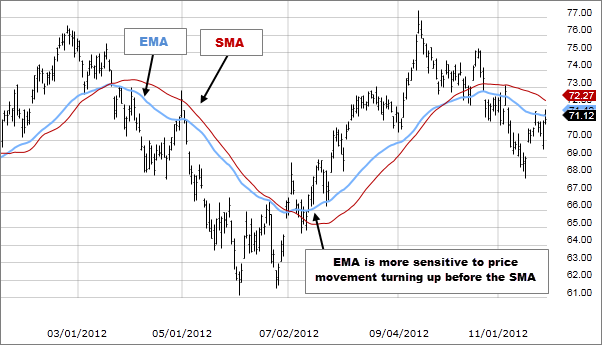

The Exponential Moving Average (EMA) is a more complex moving average indicator. It’s similar to the SMA but gives more weight to recent prices. The indicator is calculated by giving a greater weight to the most recent prices and less weight to the older prices. This means that the EMA is more sensitive to recent price changes than the SMA.

To use the EMA indicator, traders can look for crossovers between the EMA line and the price of the currency pair. When the price of the currency pair crosses above the EMA line, it’s a bullish signal, and when the price crosses below the EMA line, it’s a bearish signal. Traders can use these signals to enter or exit trades.

Exponential Moving Average vs Simple Moving Average

While both indicators are used to identify trends, the EMA is more sensitive to recent price changes than the SMA. This means that the EMA can provide signals for potential trend changes earlier than the SMA. However, the SMA is more stable and less prone to false signals than the EMA.

How to Use the Moving Average Indicators

To use the moving average indicator, traders begin by selecting a time frame for the moving average. The time frame can be short-term, medium-term, or long-term, depending on the trader’s preferences and trading strategy. For example, a short-term moving average might be calculated over a period of 10 or 20 days, while a long-term moving average might be calculated over a period of 50 or 200 days.

Once the time frame is selected, the moving average line is plotted on the price chart. This line represents the average price of a currency pair over the specified period of time. As the price of the currency pair fluctuates, the moving average line moves up and down accordingly.

Traders use the moving average line to identify trends in the market. If the price of the currency pair is consistently trading above the moving average line, it’s considered a bullish trend. If the price is consistently trading below the moving average line, it’s considered a bearish trend. If the price is trading around the moving average line, it’s considered a range-bound market or a market in consolidation.

Traders also use the moving average line as a signal to enter or exit a trade. For example, if the price of a currency pair is trading above the moving average line, a trader might use a breakout strategy and enter a long position when the price breaks above a resistance level. On the other hand, if the price of a currency pair is consistently trading below the moving average line, a trader might use a pullback strategy and enter a short position when the price retraces to a support level.

https://youtu.be/r3Ulu0jZCJI

Using Moving Averages Together

Using Different MAs Together

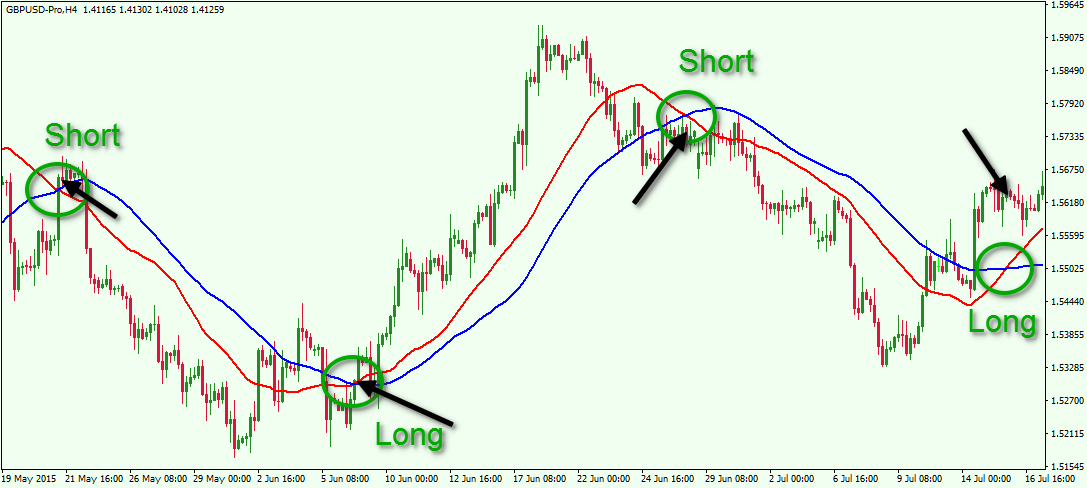

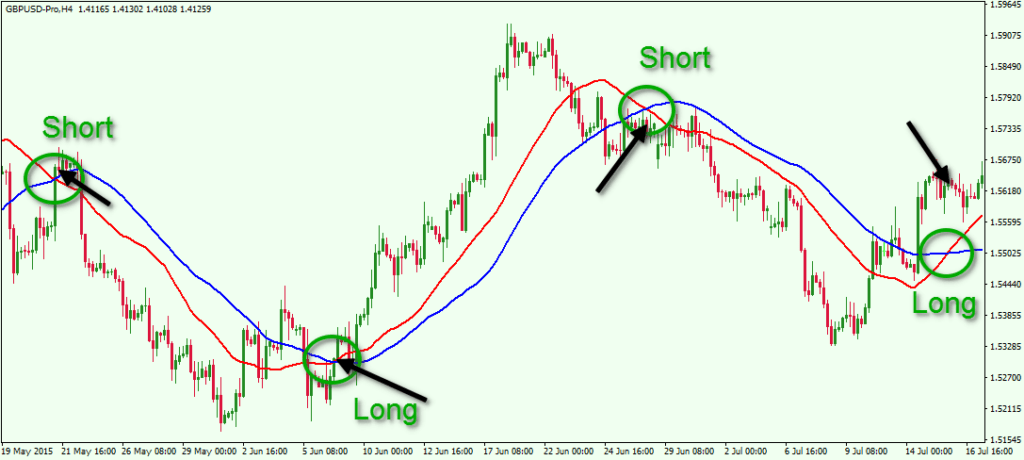

Traders can also use moving averages in combination with other indicators to confirm potential trend changes or to identify potential entry and exit points for trades. For example, traders can use the SMA and EMA together to confirm a potential trend change. If the price of the currency pair crosses above the SMA and the EMA, it may indicate a potential trend reversal and an opportunity to enter a long position.

Using Moving Average with Other Indicators

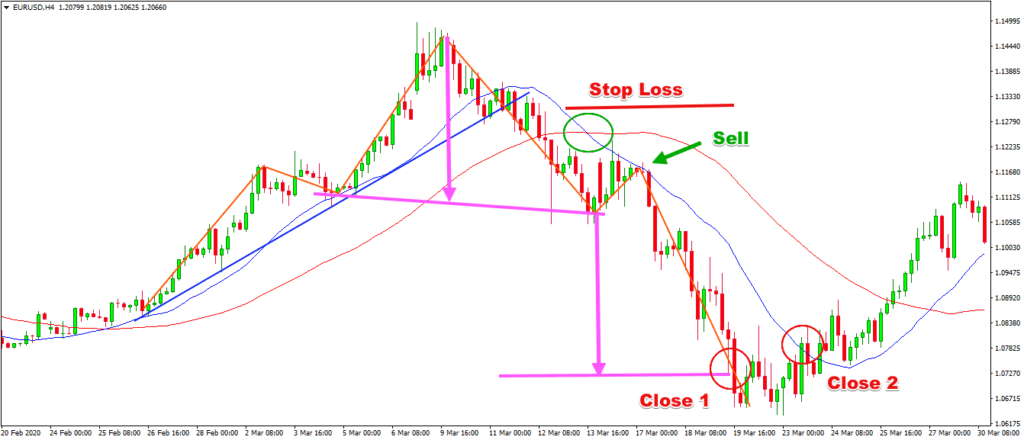

Traders can also use moving averages in conjunction with other indicators or chart patterns to identify potential entry and exit points for trades. For example, traders can use the Moving Average Convergence Divergence (MACD) indicator in combination with moving averages to confirm potential trend changes or to identify potential entry and exit points for trades.

Using Moving Averages with Price Action

Traders can also use moving averages in combination with price action to identify potential support and resistance levels or to confirm potential trend changes. For example, if the price of the currency pair is in an uptrend and retraces to the 50-period SMA, it may encounter support, which may indicate a potential price reversal and an opportunity to enter a long position.

In conclusion, moving averages are versatile Forex indicators that can be used in a variety of ways to identify trends and potential entry and exit points for trades. The SMA is a basic indicator that provides a stable representation of the currency pair’s price trend, while the EMA is a more complex indicator that’s more sensitive to recent price changes. By using these indicators in conjunction with other forms of technical and fundamental analysis, traders can gain valuable insights into the market and increase their chances of success.

If you like this post and would like to be notified of new posts, subscribe in the top right of this page. Please rate, share and comment!

My favourite prop firms:

- Funded Trading Plus (Use Coupon Code DAR10 for 10% off)

- My FAVOURITE Prop Firm (the one I use) – no minimum or maximum time limits, trade at your own pace, weekly payouts, has no issue with most all EAs

- E8 Funding (Use Coupon Code REB8 for 8% off)

- MFF

- FTMO

Want to learn more about how moving address works with RSI? Check this out: MA and RSI Strategy – Place Winning Trades

This video of mine shows exactly how to set up and use moving averages on both MT4 and TradingView.