Beginner’s Guide – What is a Lot in Forex Trading?

Forex trading, also known as foreign exchange trading, is a popular way for traders to invest and make some extra cash. But like any financial market, there are some terms and concepts that traders need to understand to succeed. So, what is a lot in Forex?

A lot is basically a standardized unit of measurement used in forex trading. It determines the size of a trade and the amount of currency that’s being bought or sold. If you’re new to forex trading, understanding what a lot is and how it’s used can be super helpful for making informed trading decisions.

So, in this article, I’m going to break down everything you need to know about lots in forex trading. I’ll explain what a lot is, how it’s used, and the different types of lots available. By the end of this article, you’ll have a solid grasp on this concept and be ready to start trading like a pro!

What is a Lot in Forex?

In forex, a lot refers to the size of a trade. It is the standardized unit used to measure the amount of currency being traded. A lot is simply a way to measure  the size of a trade in forex. It determines the amount of currency you are buying or selling.

the size of a trade in forex. It determines the amount of currency you are buying or selling.

The size of a lot can vary depending on the currency pair being traded and the broker being used. However, in general, a lot is typically 100,000 units of the base currency. The base currency is the first currency listed in a currency pair. For example, in the EUR/USD pair, the euro is the base currency.

A lot size of 100,000 units is known as a standard lot. It is the most common lot size used in forex trading. However, traders can also trade smaller lot sizes known as mini lots or micro lots.

How is a Lot Used in Forex?

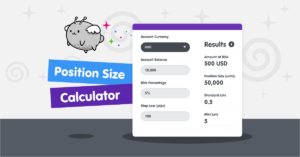

A lot is used to determine the size of a trade. When a trader wants to enter a trade, they will specify the lot size they want to use. This lot size determines the amount of currency they will buy or sell.

For example, let’s say a trader wants to buy the EUR/USD currency pair. They decide to use a standard lot size of 100,000 units. This means they will be buying 100,000 euros with US dollars. If the current exchange rate is 1.2000, they will need to pay $120,000 to buy 100,000 euros.

If the trader wanted to use a smaller lot size, they could use a mini lot or a micro lot. A mini lot is 10,000 units of the base currency, while a micro lot is 1,000 units of the base currency. Using a smaller lot size means the trader can trade with less money and take smaller positions.

Different Types of Lots

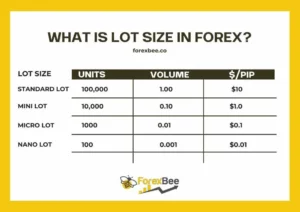

There are three main types of lots used in forex trading: standard lots, mini lots, and micro lots.

Standard Lots

A standard lot is the largest lot size available in forex trading. It is equal to 100,000 units of the base currency. This lot size is commonly used by institutional investors, banks, and large trading firms.

Trading with a standard lot size means a trader is taking a large position in the market. This can result in higher profits, but it also comes with higher risks. A single pip movement in the wrong direction can result in a significant loss.

Trading with a standard lot size means a trader is taking a large position in the market. This can result in higher profits, but it also comes with higher risks. A single pip movement in the wrong direction can result in a significant loss.

Mini Lots

A mini lot is equal to 10,000 units of the base currency. This lot size is commonly used by individual traders who want to trade with smaller amounts of money. Trading with a mini lot size allows traders to take smaller positions and manage their risk more effectively.

Micro Lots

A micro lot is equal to 1,000 units of the base currency. This lot size is the smallest available in forex trading. Trading with a micro lot size is popular among new traders who want to practice their trading strategies with small amounts of money. It is also commonly used by traders who want to trade with very small amounts of money.

Why is Lot Size Important in Forex Trading?

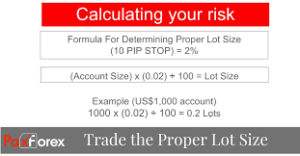

The lot size you choose is important because it can affect the potential profitability and risk of a trade. For example, larger lot sizes can result in higher profits, but they also come with higher risks. On the other hand, smaller lot sizes come with lower risks, but they will also result in smaller profits. It’s important to find the right balance between potential profitability and risk management when selecting a lot size.

How Do Lots Work With Pips and Prices in Forex Trading?

In forex trading, a pip is the smallest unit of measurement for a currency pair. It represents the change in the exchange rate for the currency pair. For most currency pairs, a pip is equal to 0.0001 or 1/100th of a cent.

The value of a pip can vary depending on the lot size being traded. If a trader is trading a standard lot size of 100,000 units and the currency pair they are trading moves by one pip, this would result in a profit or loss of $10, depending on whether the trade was long or short. If the trader is trading a mini lot size of 10,000 units, then the profit or loss for each pip movement would be $1.

The value of a pip can vary depending on the lot size being traded. If a trader is trading a standard lot size of 100,000 units and the currency pair they are trading moves by one pip, this would result in a profit or loss of $10, depending on whether the trade was long or short. If the trader is trading a mini lot size of 10,000 units, then the profit or loss for each pip movement would be $1.

When trading forex, the price of the currency pair is quoted in pips. For example, if the EUR/USD pair is trading at 1.2000 and it moves up to 1.2001, this would represent a one-pip movement. If the trader had a long position on the EUR/USD pair, they would make a profit of $10 for each standard lot size or $1 for each mini lot size.

Using Appropriate Risk Management Strategies

It’s important to consider the lot size, the associated risks, and the value of a pip before entering a trade, and to use appropriate risk management strategies to protect trading accounts. This can include setting stop-loss orders and using other risk management tools provided by your broker.

What is a Lot in Forex Trading – Conclusion

In conclusion, a lot is a standardized unit used to measure the size of a trade in forex. It is used to determine the amount of currency being bought or sold in a trade. The lot size can vary depending on the currency pair being traded and the broker being used. The three main types of lots used in forex trading are standard lots, mini lots, and micro lots.

As a forex trader, understanding the concept of lot size is crucial for managing risk and making informed trading decisions. Choosing the appropriate lot size is important because it can affect the potential profitability and risk of a trade.

When trading forex, it’s important to keep in mind that the larger the lot size, the higher the potential profit or loss. However, larger lot sizes also come with higher risks and require larger trading accounts to accommodate the margin requirements.

When trading forex, it’s important to keep in mind that the larger the lot size, the higher the potential profit or loss. However, larger lot sizes also come with higher risks and require larger trading accounts to accommodate the margin requirements.

On the other hand, smaller lot sizes come with lower risks, but they may also result in smaller profits. It’s important to find the right balance between potential profitability and risk management when selecting a lot size.

In summary, understanding what a lot is in forex and how it is used is crucial for traders who want to succeed in the forex market. It’s important to consider the size of the lot and the associated risks before entering a trade, and to use appropriate risk management strategies to protect trading accounts. With the right knowledge and approach, forex trading can be a profitable and rewarding endeavour.

My favourite prop firms:

- Funded Trading Plus (Use Coupon Code DAR10 for 10% off)

- E8 Funding (Use Coupon Code REB8 for 8% off)

- MFF

- FTMO

If you like this post and would like to be notified of new posts, subscribe in the top right of this page. Please rate, share and comment!

Check out a related post of mine: What is a Pip in Forex Trading?