What is Backtesting and Why Is It Important?

Backtesting is the process of testing a trading strategy, such as an EA, by simulating its performance using historical market data. The idea behind backtesting is to see how the strategy would have performed in the past and to estimate its potential for future performance.

Backtesting is important for several reasons:

- Evaluating the strategy: Backtesting allows traders to evaluate the effectiveness of a trading strategy, including its ability to generate profits, manage risk, and withstand market volatility.

- Identifying weaknesses: Backtesting can help traders identify weaknesses in a strategy, such as poor risk management, a lack of diversification, or an over-reliance on a single indicator. This information can then be used to improve the strategy and increase its chances of success.

- Optimizing parameters: Backtesting can be used to optimize the parameters of a strategy, such as the entry and exit rules, stop loss levels, and position sizing. This can help to improve the strategy’s performance and increase its consistency.

- Confidence building: Backtesting can help traders build confidence in a strategy by demonstrating its potential for profitability and by providing a visual representation of how the strategy would have performed in the past.

It’s important to note that backtesting is not a guarantee of future performance and that past performance is not indicative of future results. The Forex market is highly dynamic and subject to rapid changes, so it’s crucial to continuously monitor a strategy’s performance and adjust its parameters as needed.

It’s important to note that backtesting is not a guarantee of future performance and that past performance is not indicative of future results. The Forex market is highly dynamic and subject to rapid changes, so it’s crucial to continuously monitor a strategy’s performance and adjust its parameters as needed.

How to do Backtesting in MT4

MetaTrader 4 (MT4) is a popular trading platform that provides a built-in backtesting feature that enables traders to test their strategies on past market data. Here is a step-by-step guide on how to do backtesting in MT4.

Step 1: Open the Strategy Tester

Step 1: Open the Strategy Tester

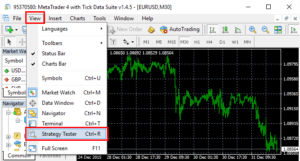

The first step to backtesting in MT4 is to open the Strategy Tester. To do this, click on the “View” menu at the top of the platform and select “Strategy Tester.” Alternatively, you can press the “Ctrl + R” keys on your keyboard.

Step 2: Choose the Expert Advisor and the Symbol

Once you have opened the Strategy Tester, the next step is to select the Expert Advisor (EA) you want to test and the currency pair (symbol) you want to test it on. To do this, click on the “Expert Advisor” dropdown menu and select the EA you want to test. Then, select the currency pair you want to test the EA on from the “Symbol” dropdown menu.

Once you have opened the Strategy Tester, the next step is to select the Expert Advisor (EA) you want to test and the currency pair (symbol) you want to test it on. To do this, click on the “Expert Advisor” dropdown menu and select the EA you want to test. Then, select the currency pair you want to test the EA on from the “Symbol” dropdown menu.

Step 3: Select the Testing Parameters

After selecting the EA and currency pair, the next step is to set the testing parameters. This includes the timeframe, date range, and testing mode. The timeframe refers to the candlestick interval you want to use for testing. The date range is the period you want to test the EA on. You can choose a specific period, such as one year, or use the “Custom” option to select a specific date range. The testing mode refers to the method of testing, such as “Every Tick” or “Open Prices Only.”

After selecting the EA and currency pair, the next step is to set the testing parameters. This includes the timeframe, date range, and testing mode. The timeframe refers to the candlestick interval you want to use for testing. The date range is the period you want to test the EA on. You can choose a specific period, such as one year, or use the “Custom” option to select a specific date range. The testing mode refers to the method of testing, such as “Every Tick” or “Open Prices Only.”

Step 4: Start the Backtesting

Once you have set the testing parameters, you can start the backtesting by clicking on the “Start” button. The backtesting process will take some time, depending on the size of the data and the complexity of the EA. During the testing process, you can monitor the progress by looking at the progress bar at the bottom of the platform.

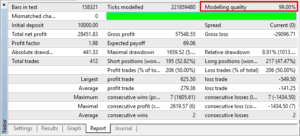

Step 5: Analyze the Results

After the backtesting is complete, you can analyze the results to evaluate the performance of the EA. The MT4 platform provides various tools for analyzing the results, including charts, graphs, and statistics. You can also export the results to Excel for further analysis.

After the backtesting is complete, you can analyze the results to evaluate the performance of the EA. The MT4 platform provides various tools for analyzing the results, including charts, graphs, and statistics. You can also export the results to Excel for further analysis.

Check out the video below that my friend, Steve Baldry, did that shows you exactly how to do this.

Conclusion

In conclusion, backtesting is an important tool for evaluating and improving trading strategies, and for building confidence in a strategy’s ability to generate profits. However, it’s important to approach backtesting with caution, as it is not a guarantee of future performance.

My favourite prop firms:

- Funded Trading Plus (Use Coupon Code DAR10 for 10% off)

- E8 Funding (Use Coupon Code REB8 for 8% off)

- MFF

- FTMO

If you like this post and would like to be notified of new posts, subscribe in the top right of this page. Please rate, share and comment!