What is Spread in Forex?

Whether you are an experienced forex trader or just learning about forex, it is important to understand what the spread means in the forex market. The spread is the difference between the bid and ask prices of a particular currency pair.

What is Spread in Forex Trading?

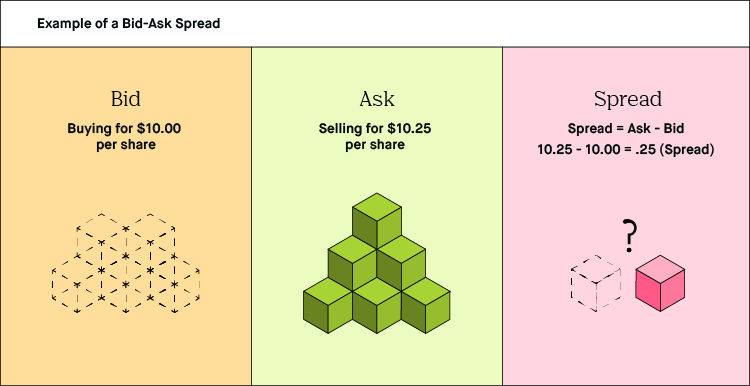

Forex brokers will quote you two different prices for a currency pair: the bid and ask price.

The “bid” is the price at which you can SELL the base currency.

The “ask” is the price at which you can BUY the base currency.

The difference between these two prices is known as the spread.

Also known as the “bid/ask spread“.

The spread is how “no commission” brokers make their money.

This spread is the fee for providing transaction immediacy. This is why the terms “transaction cost” and “bid-ask spread” are used interchangeably.

Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade.

Bid-ask spread

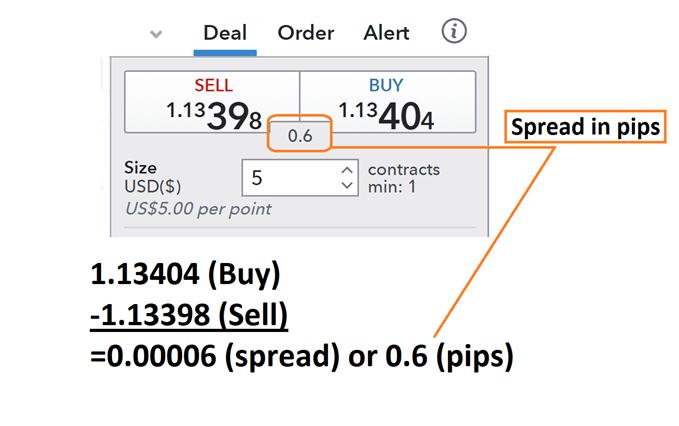

During the forex market, the bid-ask spread is the most important transaction cost. It can be calculated by multiplying the pip value of a currency pair by the number of lots traded. It is not a difficult concept to understand.

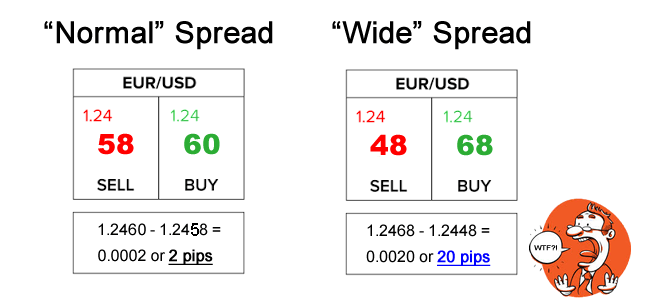

The bid-ask spread is a key indicator of the market’s state of health. In volatile markets, the market maker may quote wider prices to compensate for the higher risk. In high volume markets, concurrent rises in bids and offers tend to tighten the market dealing spread.

Despite its name, the spread is not the only way to make money in the forex market. Many retail forex brokers provide fixed spreads, which are usually consistent regardless of market conditions. A spread is usually counted as a broker’s profit margin.

The spread is also an indicator of market liquidity. It is generally easier to buy currencies without delay in a high liquidity market. The number of active market makers in a particular currency pair is a good indicator of the market’s liquidity.

The bid-ask spread has been around for a long time, but it is only in recent years that forex brokers have begun to offer the spread to their customers. The spread is an important indicator of the forex market’s health and can have a big impact on your trading.

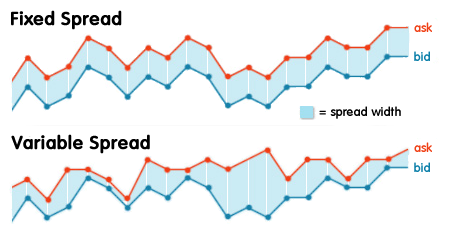

Fixed spread

Using a fixed spread in Forex can make the cost of trading much more predictable. This means that traders are better able to budget their costs before executing a trade. It also gives them added security against fluctuations.

A fixed spread is also useful for news traders. News traders often anticipate a change in the price of a product or a currency before the announcement is made. They are eager to know whether their predictions will be accurate.

Variable spreads, on the other hand, are more susceptible to the fluctuation of prices, particularly during news events. The difference between the buy and sell price can vary dramatically. It can also vary based on the type of market. For example, EUR/USD can range between 1 to 4 pips during volatile conditions.

Variable spreads are usually cheaper than fixed spreads. However, they can be a bit of a trap for beginner traders. They can also make news trading confusing. They are also less expensive during rush hours.

In addition, variable spreads can widen in uncertain markets. They also can cause profitable trades to become unprofitable. This is particularly true with currency pairs that are thinly traded.

The choice between fixed spreads and variable spreads is determined by a trader’s risk appetite and style of trading. It is also influenced by the quality of execution.

High spread

Buying or selling a currency pair in the Forex market requires the use of the spread, also known as the bid-ask spread. The bid price is the price at which you can buy the base currency, while the ask price is the rate at which you can sell that base currency.

The spread is the difference between the bid and the ask price, and is commonly quoted in pips. The number of pips varies depending on the currency pair and market conditions.

A high spread is indicative of a high volatility in the market. This means there is a lot of price fluctuations and the exchange rate is more volatile. It also means that you have to trade more to overcome the spread. If you don’t, your trades may end up in losses.

Market volume is closely linked to the spread. If a market is more liquid, the spreads tend to be tighter. On the other hand, a market with low liquidity can have wide spreads.

Spreads also change depending on the news. News events tend to produce rapid price fluctuations. Traders should avoid trading after news releases.

In the Forex market, the spread is a key indicator of profitability. It is important to determine the spread before you begin trading.

To see more of the math behind this, check out Babypips. It’s an awesome, free website with all kinds of learning resources for traders.

Do you know what a pip is? Check out my article on it: What is a Pip in Forex Trading?

If you would like to be notified of my newest posts, subscribe in the box at the top right. If you like this post, please rate, share and comment!

Related Posts

Technical Analysis: 4 Stocks with signs of death crossovers to keep an eye on

HDFC Bank & 3 other fundamentally strong stocks trading above 200 DMA to keep an eye on

Falling Channel Breakout: Multibagger NBFC Stock Shows Bullish Momentum on Daily Chart

4 Fundamentally strong stocks to buy for an upside potential of up to 36%; Do you hold any?