What is a Pip in Forex?

Keeping track of your trading results in pips can help you to limit losses and report your trading success. It can also help you to stay abreast of forex daily average ranges.

Calculating pips

Traders need to know how to calculate pips in forex trading. It helps them to assess the risk and value of their positions. They also get to know how different currency rates work. It also helps them calculate their profit.

However, the value of a pip can vary greatly. In some instances, a single pip can wipe out all of a trader’s capital. For example, if a trader has a $5,000 account and a 1% risk, he or she would lose $50 per trade. Traders can also determine their stop-loss in pips, thereby limiting losses when the currency pair moves in the wrong direction.

The value of one pip depends on the currency pair you are trading. For example, EUR/USD has a pip value of $10 per lot. This means that when the currency pair moves one pip from 1.3600 to 1.36001, the trader gets $10 in profit.

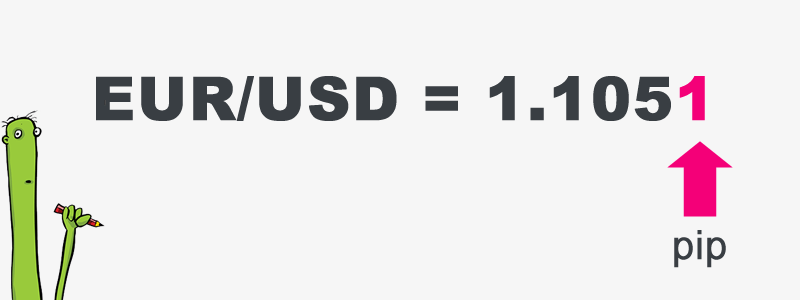

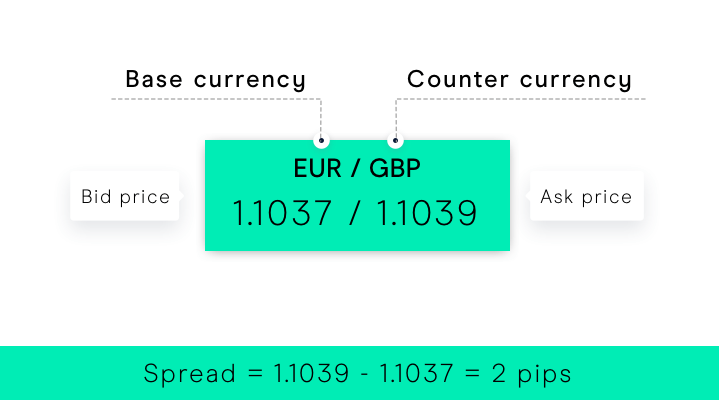

The unit of measurement to express the change in value between two currencies is called a “pip.”

If EUR/USD moves from 1.1050 to 1.1051, that .0001 USD rise in value is ONE PIP.

A pip is usually the last decimal place of a price quote

Most pairs go out to 4 decimal places, but there are some exceptions like Japanese yen pairs (they go out to two decimal places).

For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01.

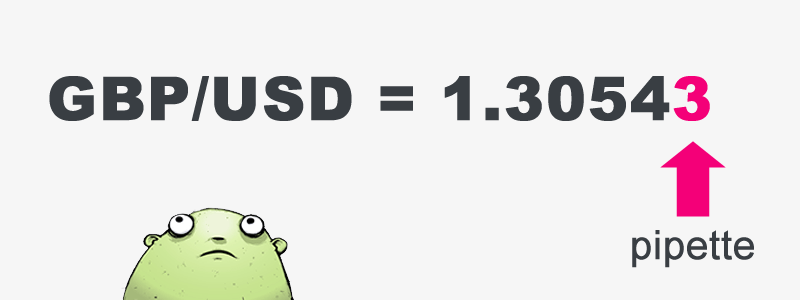

There are forex brokers that quote currency pairs beyond the standard “4 and 2” decimal places to “5 and 3” decimal places.

They are quoting FRACTIONAL PIPS, also called “points” or “pipettes.”

If the concept of a “pip” isn’t already confusing enough for the new forex trader, let’s try to make you even more confused and point out that a “point” or “pipette” or “fractional pip” is equal to a “tenth of a pip“.

For instance, if GBP/USD moves from 1.30542 to 1.30543, that .00001 USD move higher is ONE PIPETTE.

Traders can calculate their pips by multiplying the value of one pip by the size of the trade. For example, a standard lot has a pip value of $10. This is equivalent to 100,000 units of the base currency. If a trader is trading in micro lots, he or she will have a pip value of $0.10.

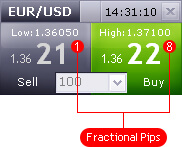

Here’s how fractional pips look like on a trading platform:

Here’s how fractional pips look like on a trading platform:

On trading platforms, the digit representing a tenth of a pip usually appears to the right of the two larger digits.

Reporting Trading Results in Pips

Using pips to measure an exchange rate is a little different than just buying and selling a currency pair. A currency pair consists of two currencies, a settlement currency and the transaction currency. In the forex world, the settlement currency is the currency that the trader is holding, while the transaction currency is the currency the trader wishes to exchange for a different currency.

Some forex brokers will quote currency pairs to up to five or more decimal places, while others will only quote currency pairs to three or less. Regardless of the number of decimal places used, pips are often the most important component of the forex puzzle, and pips a la mode are the lifeblood of any forex trader.

Keeping Abreast of Forex Daily Average Ranges With Pips

Keeping abreast of the forex trade is no small feat, and knowing a thing or two about average daily ranges is a sure fire way to put you in the good books. A little foresight goes a long way when it comes to making good money as a day trader. The biggest challenge is knowing when to buy and when to sell.

Knowing the average daily range for each of your currency pairs is a must if you want to make money in the foreign exchange market. Knowing the pip range will allow you to have a good idea how each market (Tokyo, London, New York) moves and by how much.

Stop-Loss Order Helps Limit Losses

Using a stop-loss order can help limit your losses in the forex market. Using a stop-loss order is an investment strategy that will work only if you are willing to stick to it.

Using a stop-loss order in the forex market is essential for many reasons. For one, it can help reduce your losses when the market moves against you. It also helps you manage your emotions and manage your risk.

When you are trading in the forex market, you need to be aware that you will always be risking some money. Every trade you make is risky. You need to set your stop-loss level to limit your losses and you need to have a strategy in place to deal with these losses.

The amount of stop-loss order you use depends on your risk tolerance, your investing style and your money management. If you are a long-term investor, you may want to use a wider stop-loss level. Likewise, if you are a short-term trader, you might want to use a tight stop-loss level.

For more of the math in determining pip ranges, check out the free training here: https://www.babypips.com/learn/forex/pips-and-pipettes . This is an excellent site that is chock full of free learning resources for traders.

If you enjoyed this post, subscribe at the above right to get my newest posts. Please rate, share and comment!

Related Posts

Technical Analysis: 4 Stocks with signs of death crossovers to keep an eye on

HDFC Bank & 3 other fundamentally strong stocks trading above 200 DMA to keep an eye on

Falling Channel Breakout: Multibagger NBFC Stock Shows Bullish Momentum on Daily Chart

4 Fundamentally strong stocks to buy for an upside potential of up to 36%; Do you hold any?