What is a Prop Firm?

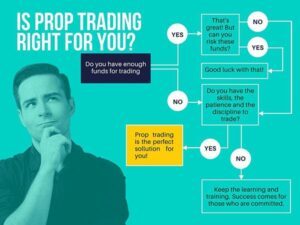

Generally speaking, a proprietary trading firm, or Prop Firm, is a financial firm that provides investors with capital in exchange for making trades on  behalf of the firm. While there are some disadvantages to using a Prop Firm, there are also many advantages. Having the financial resources available to make trades on your own can be advantageous, but it’s also important to understand how a proprietary trading firm works before you decide to invest in one.

behalf of the firm. While there are some disadvantages to using a Prop Firm, there are also many advantages. Having the financial resources available to make trades on your own can be advantageous, but it’s also important to understand how a proprietary trading firm works before you decide to invest in one.

So what risks are there when you join with a prop firm as a trader? If you’re not already an above average trader, the chance of you receiving any potential profit from this is actually very, very low. For an experienced trader who wants  to trade using a Prop Firm’s leverage, they should probably go with the prop firm over a normal account.

to trade using a Prop Firm’s leverage, they should probably go with the prop firm over a normal account.

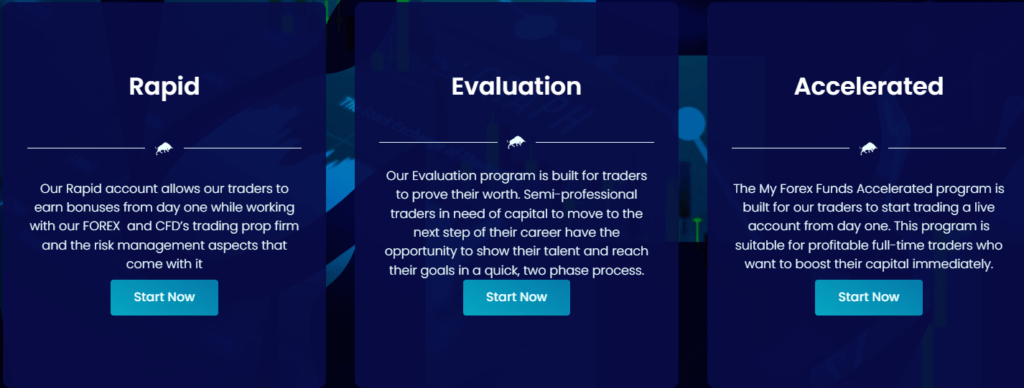

The most common prop firm style is the evaluation (or challenge) model. In this model, you pay a relatively small cost to try out the prop firm and if you pass all the parameters – usually it’s one, two or three phases – then you’ll receive an account that you can make money with. That’s generally how evaluation performance models work.

If you don’t make the profit target or if you hit one of the violations on the account, you lose whatever you paid to take the challenge. That is the cost to try out. If you fail, you lose that tryout fee. In comparison to what the total account size is, it’s usually less than one percent even of the total, stimulated account size. So for a $100,000 account, it should be around $500-600 dollars.

Main Types of Prop Firm Funding

So, these are the main types of Prop Firm funding models that you’ll see when you look them up online:

- Instant Funding

- Evaluation or Challenge Account

- Fast Scaling

- Rapid Scaling

Instant Funding

Here, they fund you instantly. They’re going to have a a medium sized profit split – usually around 50/50 or so. There’s usually a minimum you must make in order to receive a first payout, but as soon as you make that, then you can have your first payout with your instant funding ones. Again, it does depend on the specific prop firm for exactly what those parameters are.

Evaluation or Challenge

The evaluation is going to be the most popular style. It’s definitely my favourite and it’s also most people’s favourite as well. As already mentioned, in this model, you pay a relatively small cost to try out the prop firm and if you pass all the parameters – usually it’s one, two or three phases – then you’ll receive an account that you can make money with.

There’s also the personal account monitoring kind. This is one where you trade, just a normal personal account, and a prop firm is going to look at you watch as you trade it. If you trade really well they’re going to give you extra funds to trade with.

Fast Scaling

Fast scaling prop firms are usually tied together with the instant funding ones, but they’re not always necessarily the same. There are prop firms that are evaluation and fast scaling. They will double your account or significantly increase it very, very fast so as to scale it up. This usually happens once you gain a certain percentage. Whether it’s five percent, ten percent or another percent depends on the platform specifics.

Rapid Scaling

The rapid scaling plan is for those who want to trade a larger account faster. That’s why we call it rapid scaling. With the rapid scaling plan you don’t need to trade for a minimum amount of time to get the scaling. How it works is you leave your payouts in the account and so will the Prop Firm. Once the account reaches an amount above the initial risk on the account, they will then consistently top up the account every month that you’re in profit, while maintaining the same amount of risk. So the more profit you make on an account, the more they add into the account.

The idea with this plan is that you leave your profits in the account. The Prop Firm then tops up the account so that you can scale it through a much larger account, much faster. Let’s say, for example, you started off on a $100,000 account and you wanted to scale it to a million dollars. You don’t withdraw your profit share until you get to a million dollars, which can happen really quickly. Then once you’re at a million dollars you might take out, say, 50% of your profits above the million dollar mark. This would then give you a much larger payout because you’re getting a payout based on a million dollar account instead of a $100,000 account.

The idea with this plan is that you leave your profits in the account. The Prop Firm then tops up the account so that you can scale it through a much larger account, much faster. Let’s say, for example, you started off on a $100,000 account and you wanted to scale it to a million dollars. You don’t withdraw your profit share until you get to a million dollars, which can happen really quickly. Then once you’re at a million dollars you might take out, say, 50% of your profits above the million dollar mark. This would then give you a much larger payout because you’re getting a payout based on a million dollar account instead of a $100,000 account.

Are Prop Firms Real? Do They Pay Out?

Yes, Prop Firms are definitely real! There are many, many traders that are currently enjoying the massive opportunity the prop firms provide, including myself. So the most important thing to know about a prop firm is if they will payout. So, once you earn a payout, are they going to actually give you that money? Unfortunately, scam firms do exist and there’s very, very little regulation around platforms as of right now. Most platforms are legit and most of them will give you a payout. Still, it’s up to you to do your due diligence and research the firm. Check for reviews in TrustPilot, amongst other sites.

If you’re going with prop firms, you probably want one that has the same goals as you. So you want to find one that’s actually looking for good traders and that’ll actually be funding them. Traders that will actually be tracking their trades and using the data critically to to end up making a profit for them. You want them to succeed.

If you would like to learn more on this topic, please subscribe in the upper right hand corner to get notifications of new posts. Please like, rate, share and comment!

My favourite prop firms:

- Funded Trading Plus (Use Coupon Code DAR10 for 10% off)

- E8 Funding (Use Coupon Code REB8 for 8% off)

- MFF

- FTMO

Here is another article of mine on this topic: What is Proprietary Trading?

Related Posts

Technical Analysis: 4 Stocks with signs of death crossovers to keep an eye on

HDFC Bank & 3 other fundamentally strong stocks trading above 200 DMA to keep an eye on

Falling Channel Breakout: Multibagger NBFC Stock Shows Bullish Momentum on Daily Chart

4 Fundamentally strong stocks to buy for an upside potential of up to 36%; Do you hold any?